Exchange-traded funds (ETFs) are revolutionizing investing, giving investors easy access to diverse portfolios at low costs. Among ETF providers, Vanguard has built a reputation for investor-friendly operations and lowest fees. The firm’s wide range of funds covers nearly every corner of the market, from full stock indexes to sector-specific products.

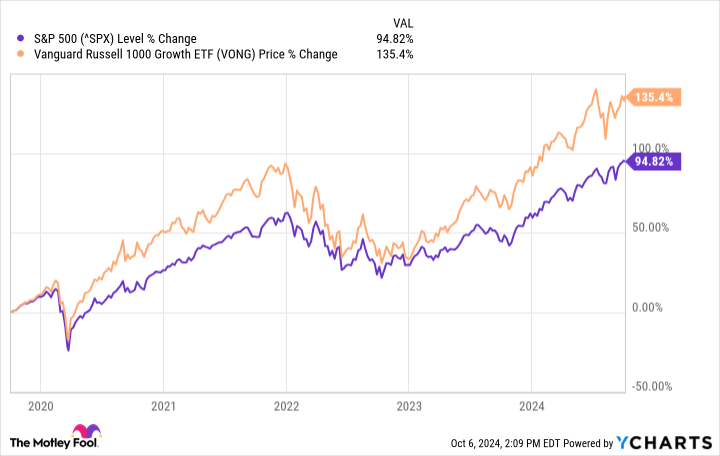

One Vanguard ETF that has garnered attention from growth-oriented investors is the Vanguard Russell 1000 Growth ETF (NASDAQ: VONG). The fund has delivered impressive returns in recent years, even outperforming the popular S&P 500.

^SPX Chart

But with valuations reaching their limits and economic uncertainty looming, investors may wonder whether the Vanguard Russell 1000 Growth ETF can continue its way of outperforming the market. Let’s take a closer look at this highly rated fund to see if it’s worth adding to your portfolio.

Image source: Getty Images.

The driving force behind growth

The Vanguard Russell 1000 Growth ETF tracks the Russell 1000 Growth Index, which is comprised of large-cap U.S. growth stocks. This index represents approximately 93% of the market capitalization of all publicly traded stocks on the U.S. stock market. The fund aims to closely track index returns and provides investors with exposure to some of the fastest growing large companies in the United States.

The Vanguard Russell 1000 Growth ETF has delivered an impressive performance with a year-to-date return of 23.6% as of October 4, 2024. This return beats the S&P 500 over the same period, with the benchmark index up about 20.5 points. % this year. Even more impressive, the fund has generated a total return of 357.6% over the past 10 years, assuming dividends are reinvested, making it one of Vanguard’s best-performing growth funds over this period. are.

Technology-heavy portfolio

The Vanguard Russell 1000 Growth ETF’s top holdings seem to be a portrait of big tech figures. Apple, Microsoft, and Nvidia occupy the top three positions, accounting for over 34% of the portfolio. Other major holdings include Amazon, Meta Platforms, and Alphabet. This technology concentration has been a key driver of ETF outperformance in recent years.

However, this focus on technology also brings concentration risks. Technology stocks account for nearly 60% of the fund’s assets. This has boosted returns in the tech bull market, but could lead to underperformance if the sector faces headwinds. Fortunately for investors, given the rapid advances in advanced artificial intelligence, robotics, and self-driving cars, a slowdown in this sector seems unlikely in the short term.

story continues

Increase profits at lower costs

One of the key benefits of the Vanguard Russell 1000 Growth ETF is its lowest expense ratio of just 0.08%. The fund’s expense ratio is significantly lower than the 0.94% average for similar funds. These lower fees mean more of the fund’s income flows to investors, improving long-term performance.

ETFs’ efficient index-based approach also leads to low turnover. The Vanguard Russell 1000 Growth ETF had a volume of just 14.4% in its most recent fiscal year. Low turnover minimizes transaction costs and tax implications for shareholders.

Is the Vanguard Russell 1000 Growth ETF still a buy?

The Vanguard Russell 1000 Growth ETF provides investors with exposure to some of America’s most innovative and fastest-growing large companies. Its strong past performance and low fees make it an attractive option for growth-oriented investors. However, the fund’s high technology concentration and relatively high valuation metrics (e.g. price/earnings ratio of 36.8) create important risk factors to consider.

The Vanguard Russell 1000 Growth ETF may continue to outperform, but it may be more volatile than broader market index funds like the Vanguard Total Stock Market ETF. The potential for increased volatility is due to high-tech concentration and premium valuations. Nevertheless, for investors accustomed to these particular risk factors, this ETF remains an attractive option for capturing the growth potential of major US companies.

Don’t miss out on this potentially lucrative second chance

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts will issue a “Double Down” stock recommendation on a company we think is about to crash. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

Amazon: If you invested $1,006 when it doubled in 2010, you would have earned $21,006. *

Apple: If you invested $1,000 when it doubled in 2008, you would have earned $42,905. *

Netflix: If you invested $1,000 when it doubled in 2004, you would have earned $388,128. *

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor will return as of October 7, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Suzanne Frey, an Alphabet executive, is a member of the Motley Fool’s board of directors. George Budwell has held positions at Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Total Stock Market ETFs. The Motley Fool recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

Is this top-performing Vanguard fund still a buy?Originally published by The Motley Fool